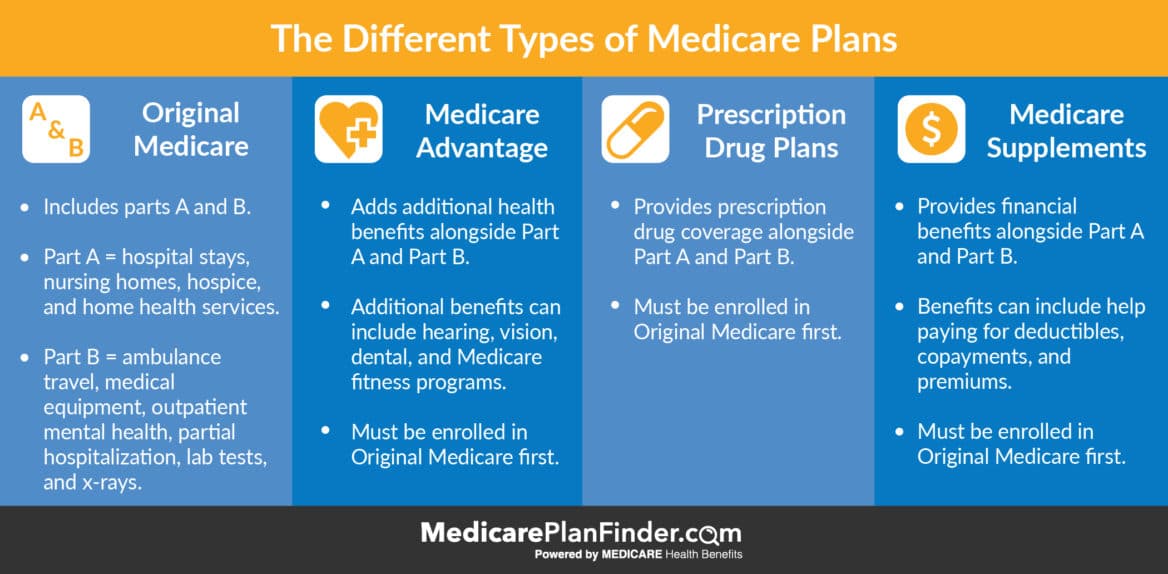

Annual deductible: The maximum yearly deductible for Medicare Part D is $505 in 2023, although many plans set a lower deductible (and some have it at $0).If you join a Medicare Advantage Prescription Drug plan, you may also have the following costs for your Part D coverage: If you don't have a Medigap plan, there is no limit to how much you may owe in a calendar year under Original Medicare. Original Medicare has no yearly max, by the way. CMS sets a limit for this ($8,300 for in-network services in 2023, $11,300 for out-of-network services), although many plans offer a lower MOOP. Maximum out-of-pocket: Also referred to as MOOP, Medicare Advantage plans have a yearly max you'll spend for services.Co-pays are usually set, so it's easy for you to know what you're going to pay at the doctor's office, lab, etc. For example, you typically pay 20% co-insurance for covered services under Original Medicare. Co-insurance or co-pays: Co-insurance is usually a percentage of the approved cost while co-payments will typically be a set dollar amount.Costs vary according to the plan provider, but many MA plans have no annual deductible. Yearly deductible: This is the amount you must pay out-of-pocket before your plan starts paying.Including premium-free plans, the average Medicare Advantage plan premium is $18 in 2023. Monthly premium: Only around 40% of MA plans have a monthly premium, although two states – Alaska and Wyoming – do not have $0 premium plans available.Please note that, even if your Medicare Advantage plan has a monthly premium, you will still owe the Medicare Part B premium, $164.90 in 2023.Ĭosts you can expect with an Advantage plan include: Medicare Advantage plans are provided by private insurance companies, who set their own rates. What you pay for Medicare Part C depends on the plan and insurance provider you choose. You can also call toll-free to speak with a licensed Medicare agent who will answer all your questions and help find the best plan for you. The easiest, quickest way to find and compare Medicare Advantage plans is with our Find a Plan tool. ( Related reading: Understanding the Medicare Part D Formulary) The tiers tell you about what you can expect to pay for them. The formulary tells you whether the plan covers your medications. Does it cover your medications: If you choose a Medicare Advantage Prescription Drug plan (MA-PD), make sure you check the drug formulary and tiers.We discuss these more in the next section. Out-of-pocket costs: In addition to monthly premiums, you want to consider deductibles, co-pays or co-insurance, and the yearly out-of-pocket max.If keeping your doctor is important, make sure they accept the plan before you make the switch. Provider networks: Most Medicare Advantage plans have a provider network, which may include doctors, hospitals, clinics, durable medical equipment providers, labs, pharmacies, and more.

So check out the plan's extras, including whether there are any you don't think are worth paying extra for.

#COMPARE MEDICARE ADVANTAGE PLANS IN MAINE HOW TO#

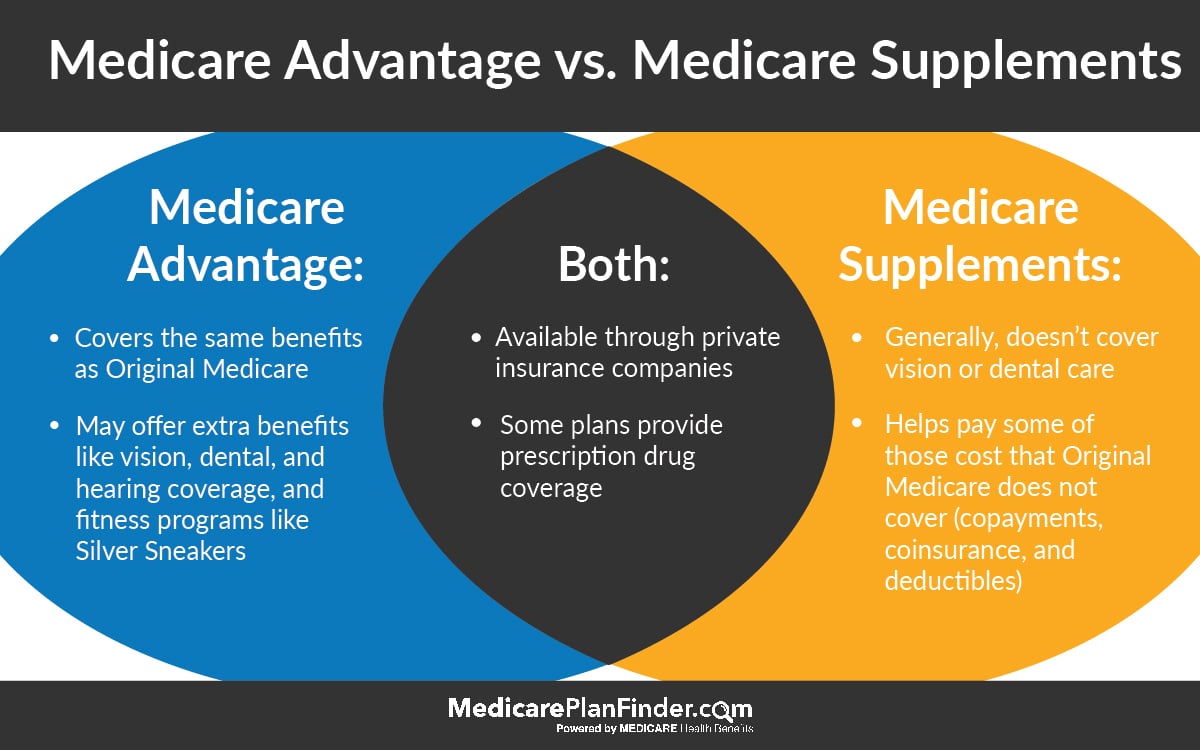

This page walks you through what you can expect from an Advantage plan and how to compare Medicare plans in your area. And most MA plans – around 90% – offer significantly more than what Original Medicare covers. Fortunately, federal law only sets the minimum coverage Medicare Advantage plans must provide – it doesn't limit them to those benefits. Of course, if that was all you got with Medicare Advantage (MA), the plans wouldn't be as popular as they are.

Also known as Medicare Part C, Medicare Advantage plans combine all of the benefits you get with Original Medicare (Parts A and B) into a health insurance plan that is very similar to what many of us had with an employer.

0 kommentar(er)

0 kommentar(er)